Managing money is not an easy task. There are different variables to take into account in order to succeed. With the rise of technology, new tools are surfacing regularly to help people get to a decent place with their finances.

Finding the right balance between wants, needs, savings, and debt repayment has never been a simple equation. However, smartphones and technology are trying to make the process a little bit easier.

No matter the era, discipline and staying on track are critical elements in making a budget work for you. Budget apps are some of the latest tools that can help you keep up and manage your finances in a more efficient way.

Good budget apps are the ones that help you see rapidly where your money is going by tracking the way you spend. Moreover, they can put your expenses in different categories.

All of this is possible because they are linked directly to your different accounts. However, these functionalities are just a starting point because some money apps do go further in the things that they can accomplish.

So, what do the best budget apps have in common? They let users access them via mobile or desktop connections. They make it possible to track bills and tell you when a due date is fast approaching.

The better apps are not just tracking your most recent transactions; they help you plan for some important financial decisions. It also should not be a hassle if you want to share financial information with partners or do some syncing between accounts.

In short, a good money app gives a great deal of freedom. Based on many of those crucial points, you will find information below on some of the 16 best budget apps.

Empower Your Finances: Try Out These 7 Free Budgeting Apps

When it comes to money management apps and budget planners, some of the free options are worth exploring.

1. Mint

If you are looking for the gold standard of free budgeting apps, please look no further than Mint. It has been a top player on the market for quite some time and has a reputation that is hard to match.

It was founded in 2006 by Aaron Patzer. After an acquisition by Intuit in 2009, it became Intuit Mint in some corners. Intuit is the company behind TurboTax, Credit Karma, and QuickBooks.

Mint stands out because it is free and very easy to use. Moreover, there is broad agreement over its effectiveness. The app has excellent ratings on Google Play and the App Store.

If you want to sync different types of accounts, like checking and savings, it is a simple process. An interesting plus is the fact that you can keep an eye on your credit score with this budget app.

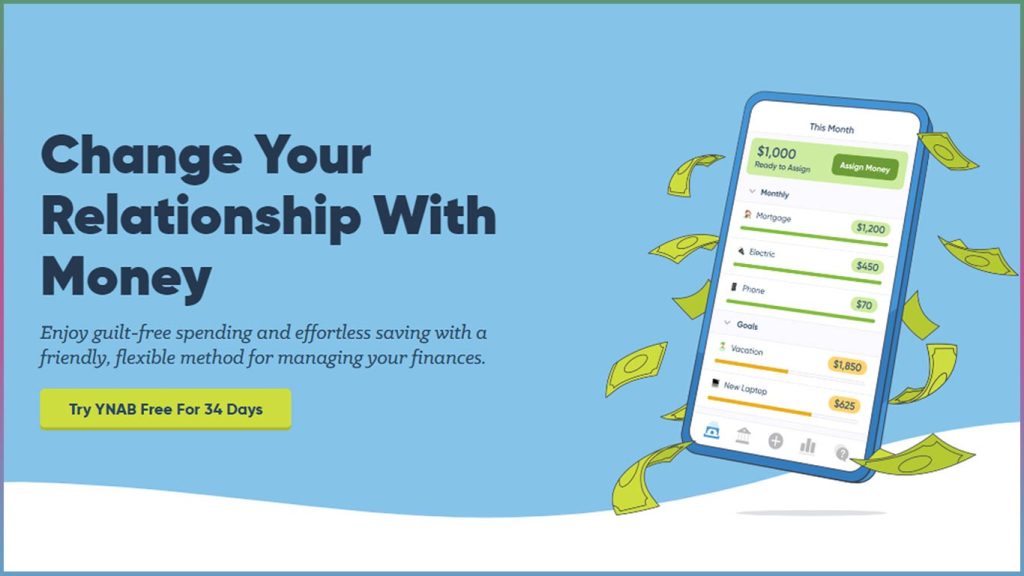

2. YNAB

You Need a Budget (YNAB) was launched in 2004. It has a very loyal fan base and is quite popular with young professionals. It has a very cool side that helps it attract new users

This app is less about past transactions and concentrates more on the financial decision-making process. In that aspect, it is way ahead of the competition.

YNAB does not ignore small details and wants to know exactly how you plan to spend every dollar that you make.

The app has a free 34-day trial period, after which you have to decide if you plan to go premium at $99 per year or $14.99 per month.

College students can get one year free. Other users may sign up for free online classes to help better manage their money. Some say that this app fits perfectly those who take budgeting very seriously.

Also Read: Money Saving Tips for College Students

3. PocketGuard

PocketGuard connects to your different financial accounts in order to track your spending. It is especially good for managing cash to have a clear idea about your financial situation.

Unlike some of the other apps, PocketGuard makes simplicity a central theme in its pitch to new users. It also has an additional feature that is quite interesting to many; it tracks your net worth in real time.

It is best suited for those that are looking for a budget app that is independent and does a lot on its own. Of course, it is also possible to do some of these things manually.

PocketGuard has a basic version that is free. However, if you are looking for more features, three options exist. You can opt to pay $79.99 for a lifetime license.

The monthly fee is set at $7.99, and the yearly subscription goes for $34.99. It is the ideal app for so-called over-spenders.

4. GoodBudget

The GoodBudget app is a bit different compared to the previous ones. It does less tracking and focuses more on planning. While it is a pretty solid product, it does not sync with your different accounts automatically.

You will have to add the different numbers manually. Thanks to the system it has in place, the GoodBudget application can split your monthly income and direct the portions to specific categories.

The app is available on desktop and mobile, and the free version is quite solid. However, for $70 per year or $8 per month, you can have more freedom.

The premium option makes it possible to use up to five devices and unlimited accounts versus just two for the free one.

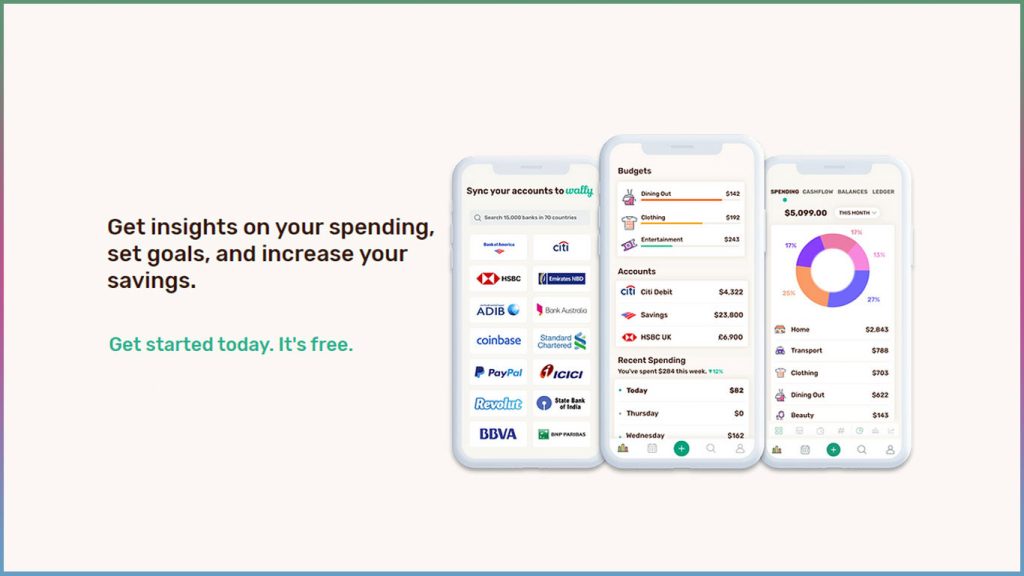

5. Wally

Wally is worth a moment when you are looking at solid personal finance apps. It might be basic, but it does cover the essentials. That is more than enough for most people.

It can track income and expenses and lets you know when bills are due. You can enter some numbers manually or just take a photo of the different receipts.

You can use it via desktop and mobile. Foreign currencies are also not an issue for this app. It is mostly free.

However, for $1.99 per month, you can try the premium version, which is called Wally Gold. A lifetime option is available at $39.99, and the yearly subscription goes for $24.99

6. EveryDollar

EveryDollar is a budgeting app that aims to put you in the driver’s seat when it comes to your personal finances. You can keep track of your money using a desktop computer or mobile device.

The app does a good job in general. However, the free version lacks certain things that might be of importance. You will need to upgrade to get some additional perks like sync accounts.

The same goes for bill reminders. The upgrade is priced at $79..99 per year or $12.99 after a 14-day trial. Supporters praise it because the updates and tweaks are regular, which is not the case for some of the other apps.

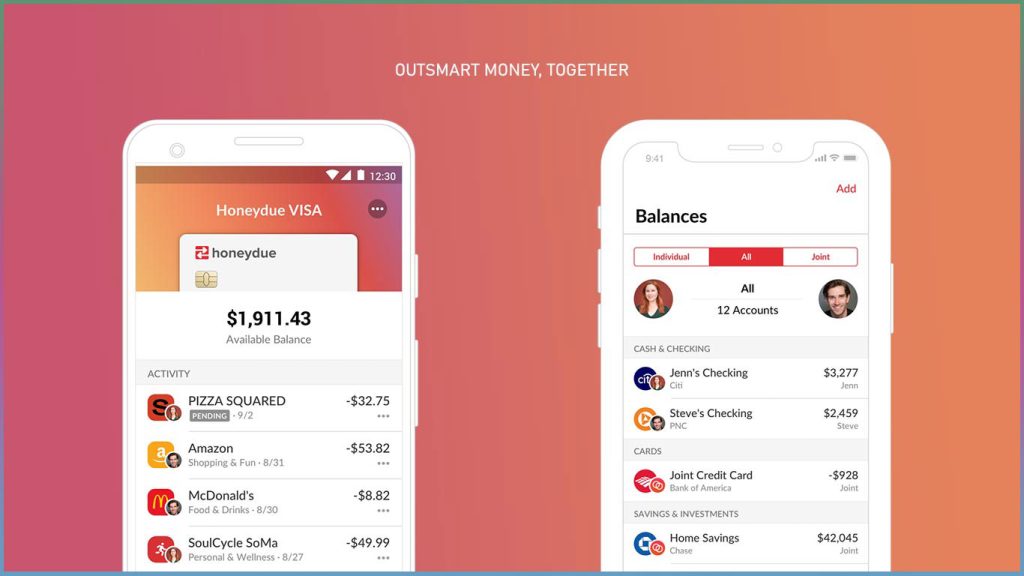

7. Honeydue

As a free budget app, Honeydue stands out for a very specific reason. It mostly targets couples. The partners can share the state of their finances through the app.

While you can sync all your different accounts and give the other person access to the information, you can also put some restrictions on what they can see.

Honeydue tracks your expenses and can categorize them automatically. Moreover, it is still possible for you to add more categories on your own.

Critics say that it does not do enough in terms of financial planning. It is available through the App Store and Google Play.

Those seven free budget apps have a lot of great things going for them. However, in some cases, you might need one to address more specific needs.

For example, there is an app that is better tailored for investments.

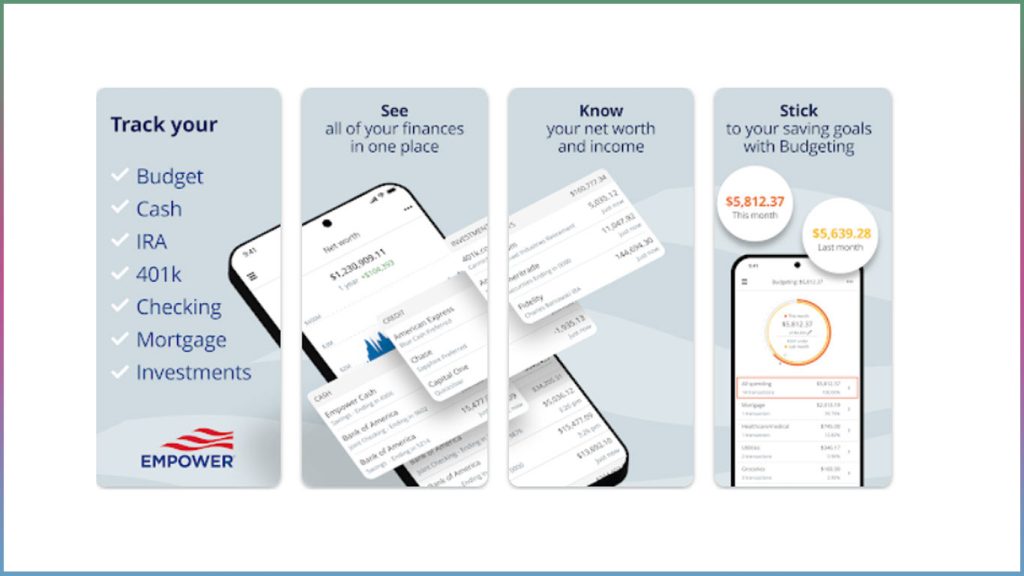

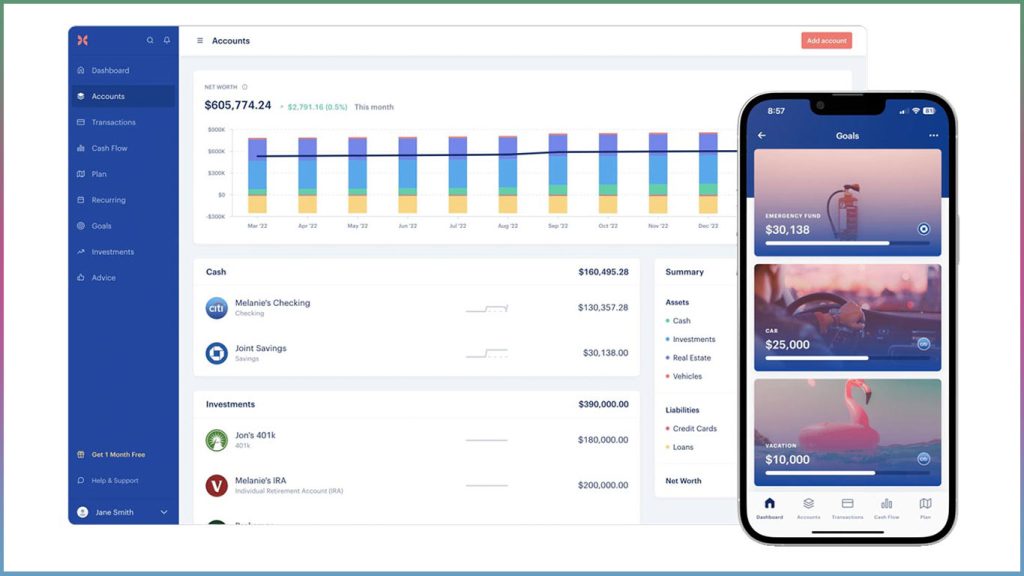

Best Budgeting App for Investors: Empower Personal Wealth

Formerly known as Personal Capital, Empower Personal Wealth is, first and foremost, an investment tool. However, it can be useful for others who want to get in control of their budget.

This app covers very different accounts, from bank and credit cards to IRAs, 401(k)s, mortgages, and loans. This means that if you want to sync, there will not be any problems.

The app is mostly free. However, for the investment management aspect, a fee will be required. It corresponds to 0.89% of the money for any amount under $1 million.

Before opting for Empower, it is important to remember that its forte is really tracking investments. If you are looking for something really simple, the next application might be the right one for you.

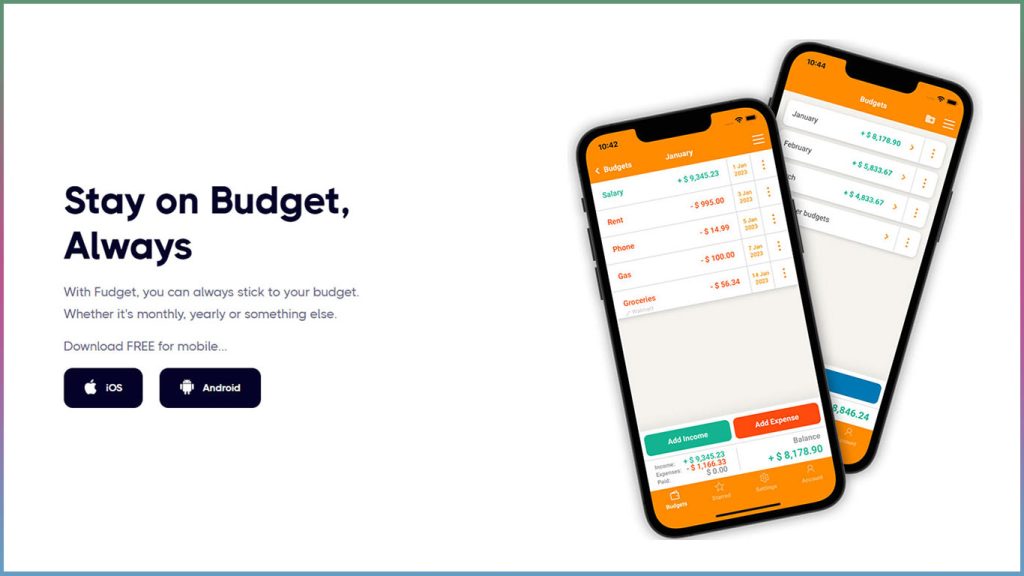

Best Budgeting App for Simplicity: Fudget

Fudget is really straightforward and embraces a simple interface. It is so much to the point that it may remind you of a calculator. The app does not waste your time with fancy concepts.

It is so basic that you will not be able to sync accounts. The goal is to keep your focus on the money that is coming in and what is going out.

Fudget is free, but there is a pro version with a one-time fee of $3.99. While it may not be the right fit for everyone because of its simplicity, users tend to give it good grades.

That is the case at the App Store and Google Play. It could look like a decent choice for beginners. However, there are better options.

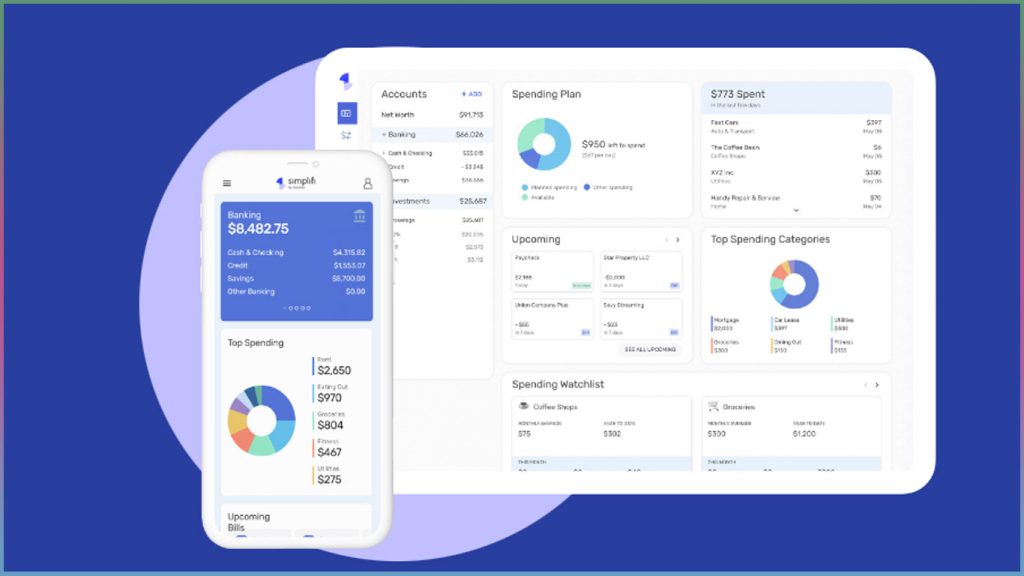

Best Budgeting App for Beginners: Simplifi by Quicken

Quicken offers a simple tool for those who are starting their budgeting journey. The mobile app has a few things going for it, like the fact it is from a brand that has a solid reputation.

Simplifi offers spending plans and keeps track of your bills. The app does not contain ads, but it comes at a price. You have a choice between a yearly subscription at $35.99 versus $5.99 per month.

The price may go down a bit if you can get your hands on a coupon or promo code. However, if you do not like it, there is a 30-day money-back guarantee that gives you an easy way out.

For those who are fans of customization, the next app might be the answer.

Best Budgeting App for Customization: Monarch

If you are a person who appreciates having a high degree of control over the way a particular app presents itself, Monarch tries to fit the bill. Whether it is on a desktop or phone, users can move widgets around to their liking.

The visuals are interesting, and you can reorganize the categories of spending in a way that is suitable to your needs. Monarch can also keep you up to date on your net worth and the bills that need to be handled. Sharing your financial information with a partner is also on the list of features.

The app is set at $99.99 annually or $14.99 monthly. For those on the hunt for a product that is more minimalist, your banking app might be the solution.

Best Budgeting App That Requires the Least Effort: Your Bank

If you are trying to keep things really simple and do not want to download another app, your banking app might be able to help out. Some banking apps like Chase and Bank of America have budgeting tools for customers.

Those apps track spending and make sure that you do not spend more than you can afford. Other banks are also offering the same service, so it is wise to look before getting a different app.

Here are some other apps that are worth a mention.

Other Budgeting Apps That Stand Out

BusyKid: this is the best app if you want to start teaching budgeting to your children very early on. The child can keep track of their allowance and categorize their spending.

Rocket Money: Previously known as TrueBill, Rocket Money takes a good look at your bills and expenses and then tells you the areas where you could save some money.

It goes pretty far in this mission. For example, it helps get bank refunds. The app will take a percentage of the savings at the end of the year.

Trim: This one has similar goals to its predecessor. It offers free cancellation services in order to help you save money.

Checkout 51: If you are looking for an app that will save you some money on groceries, Checkout 51 is on top of that. You can download it for free and get cash back whenever you purchase something.

That is not all, you can take pictures of your receipt to get more savings in the future. When your savings reach a minimum of $20, you can request the cash via PayPal or a regular check.

Bottom line

There are many great budget apps available; however, not all of them will speak to you the same way. It is critical to take a moment and explore the different options to find the one that can help you stay on track financially.

Thanks to technology, you are not on your own when it comes to finding ways to save money. Nonetheless, the best money management apps and budget planners are not enough if you do not have the right mindset.

Moreover, taking care of your personal finances also has to be about discipline and should include important elements like the 50/30/20 budget rule. So, it is okay if you take your time to reach the place where you see financial freedom as a goal that is worth all of the efforts required.

Most Viewed

Cheapest Grocery Store in 2024 – Save Big on Food and Groceries!

The Healthiest Foods under $48 to Add to your Cheap Grocery List Right Now!

10 Budget-Friendly Kids’ Favorite Foods for Picky Eaters

How to Stop Spending Money on Food for Healthier Living